April 2025: Q1 2025 U.S. Jobs Report

Guest Post: Happy Friday, Job Board Doctor friends! I am thrilled to announce a new partnership with Aspen Tech Labs. Our teams have joined up to share a monthly deep dive into the state of the labor market using Aspen’s Job Market Pulse Report. This month we will focus on the Q1 2025 U.S. Jobs Report, but we will explore non-US data throughout the year, too. Thank you to Mike Woodrow, Lana Shumyn, and the entire Aspen Tech Labs team. So let me know what you think. Til next week, The Doc.

The job market is constantly evolving, shaped by economic swings, political developments, the lasting effects of the pandemic, and rapid advances in technology (AI, in particular). At Aspen Tech Labs, we’ve been tracking these changes closely and sharing what we learn along the way.

The job market is constantly evolving, shaped by economic swings, political developments, the lasting effects of the pandemic, and rapid advances in technology (AI, in particular). At Aspen Tech Labs, we’ve been tracking these changes closely and sharing what we learn along the way.

We recently published our Q1 US Jobs Report, and I’m excited to highlight a few key takeaways for the Job Board Doctor audience. Hopefully, these insights help bring some clarity to where the market stands and where it might be headed.

It’s important to note that our analysis is based exclusively on job posting data we gather, ensuring unbiased insights. This data, sourced directly from over 140,000 companies’ career sites (not job boards) across the US and updated daily, offers a highly representative view.

So, what’s currently happening in the US Labor Market, and how does it compare to last year?

1. Q1 U.S. Job Market Overview: Decline in vacancies from the previous year

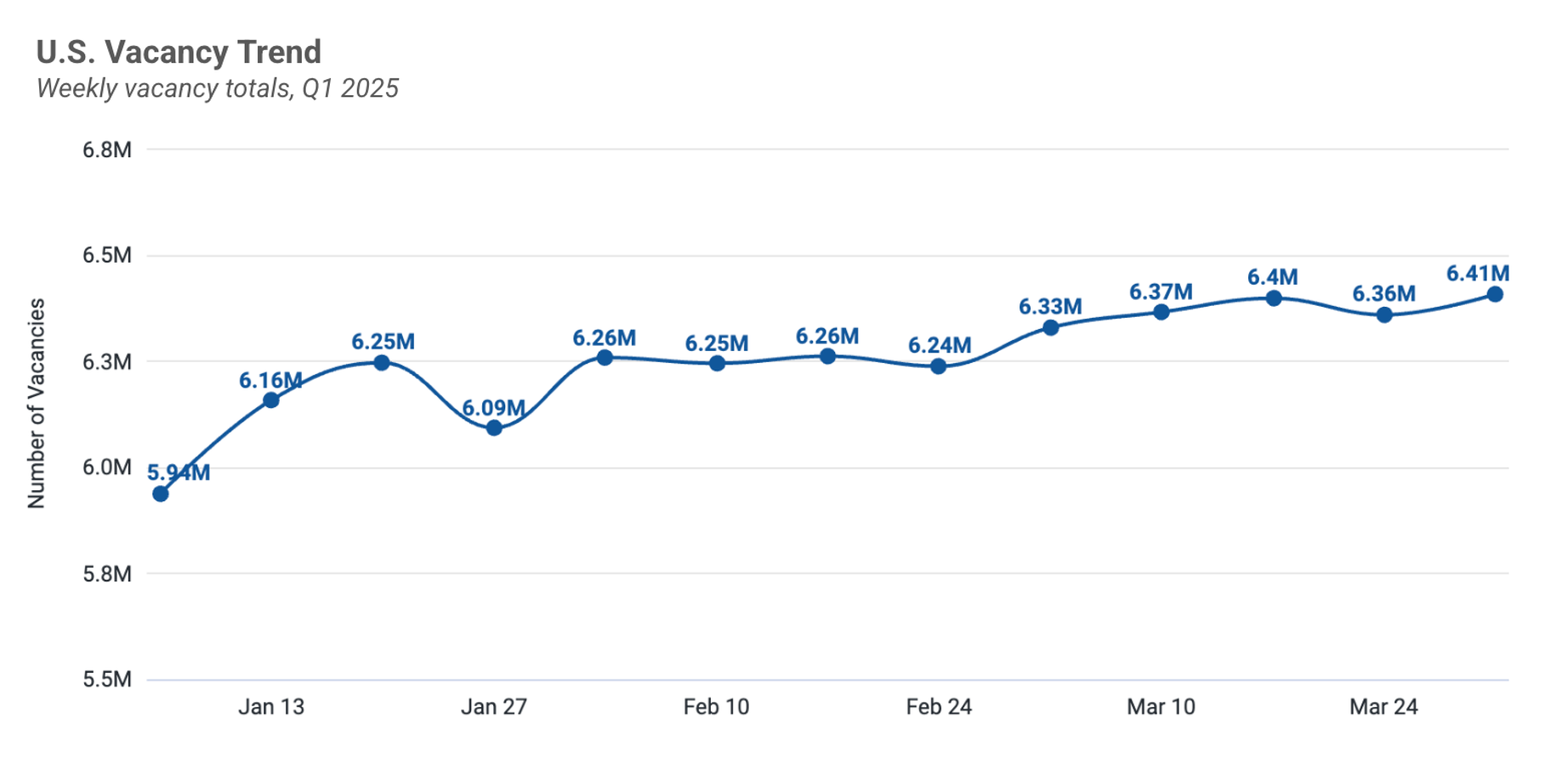

Job vacancies rose by 7.7% in Q1, approximately 459,000 additional listings between January 6 and March 3. This growth marks a renewed expansion in the labor market following a contraction towards the end of 2024, which itself came after a year of little change. However, as compared to Q1 2024, vacancies have declined by 0.7%.

So, to clarify, lots of job postings were added in Q1 vs the end of 2024 (up 7.7%), but vs same quarter last year, they are down about 1%. We are closely monitoring this in April 2025, and we are already seeing some weakness as we get into Q2.

2. Industry-specific Observations: Education and Healthcare Lead the Way

At the start of the year in both 2024 and 2025 we have seen an increase in education-related job postings, with a 24% increase in Q1 2024 and another 24% growth in Q1 2025, reflecting cyclical hiring patterns tied to academic calendars.

Healthcare roles, particularly Registered Nurses, have also been consistently high in demand, leading Q1 2025 with 430,000 job postings. Sales positions also saw sustained growth, emphasizing stable demand in essential sectors.

In contrast, the retail and restaurant industries faced declines in Q1 2024, impacted by post-holiday normalization, while in Q1 2025, sectors like Professional Services and Legal roles saw a downturn, possibly due to cautious discretionary spending amid economic uncertainty.

3. Rising Salary Transparency and Salary Trends

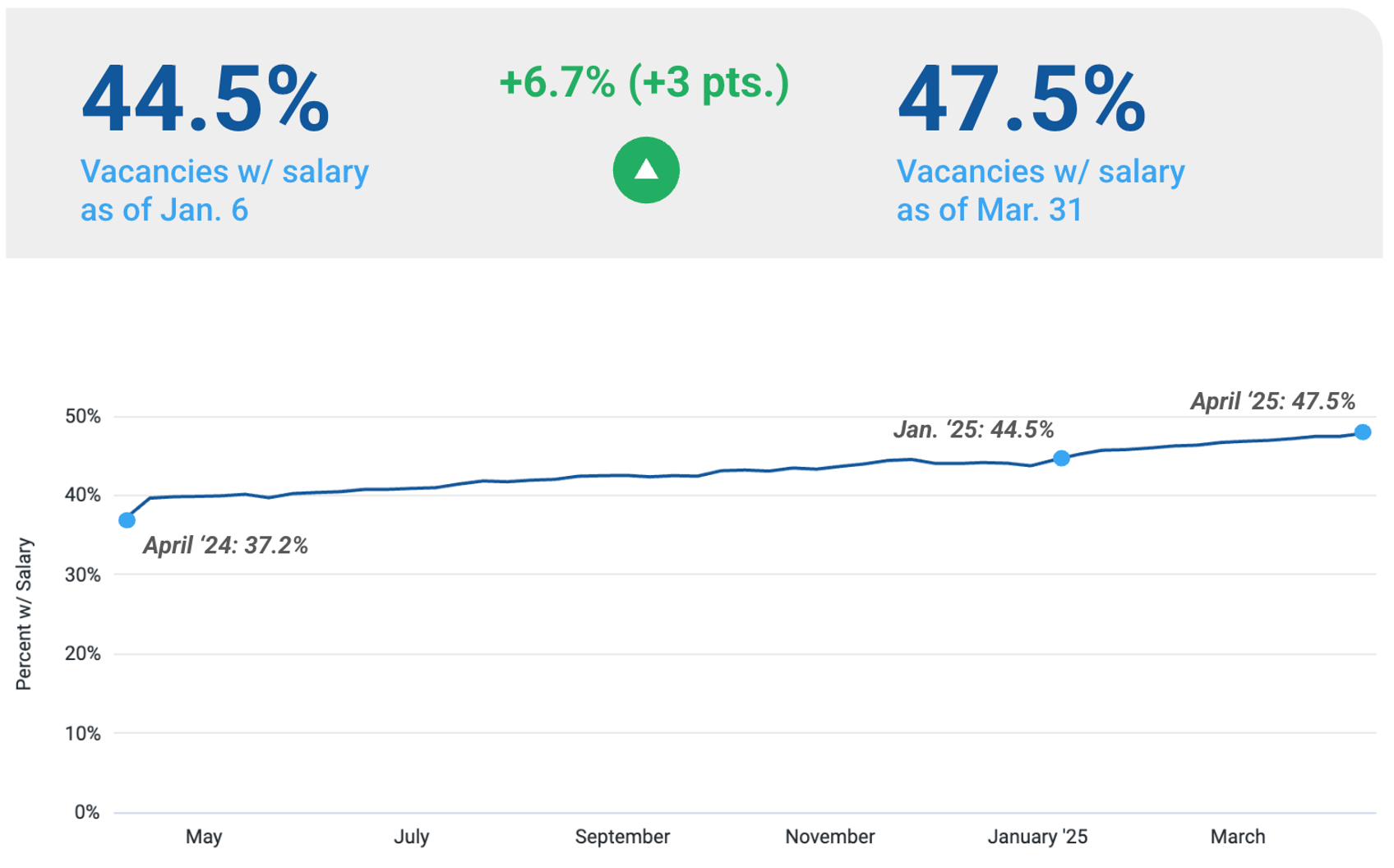

Salary transparency has continued to rise significantly, jumping from 36.9% of job listings in Q1 2024 to 47.5% in Q1 2025. This shift is largely driven by evolving candidate expectations and new salary disclosure laws, making pay transparency increasingly standard nationwide.

Median full-time salaries also grew from $55,141 in Q1 2024 to $60,320 in Q1 2025, a modest quarterly rise but part of an overall 8.7% annual increase. This upward trend highlights a healthy economic outlook despite ongoing inflation pressures.

4. Geographic Differences and Remote Work Trends

Geographical job market variations were significant in Q1 2025. States like West Virginia, South Carolina, and Colorado saw substantial vacancy growth of over 10%, signaling strong regional economic activity. Meanwhile, locations like Hawaii (-4%) and the District of Columbia (-2%) experienced contractions. Again, we are watching Q2 closely, and we expect some of these increases to reverse. But, only time will tell.

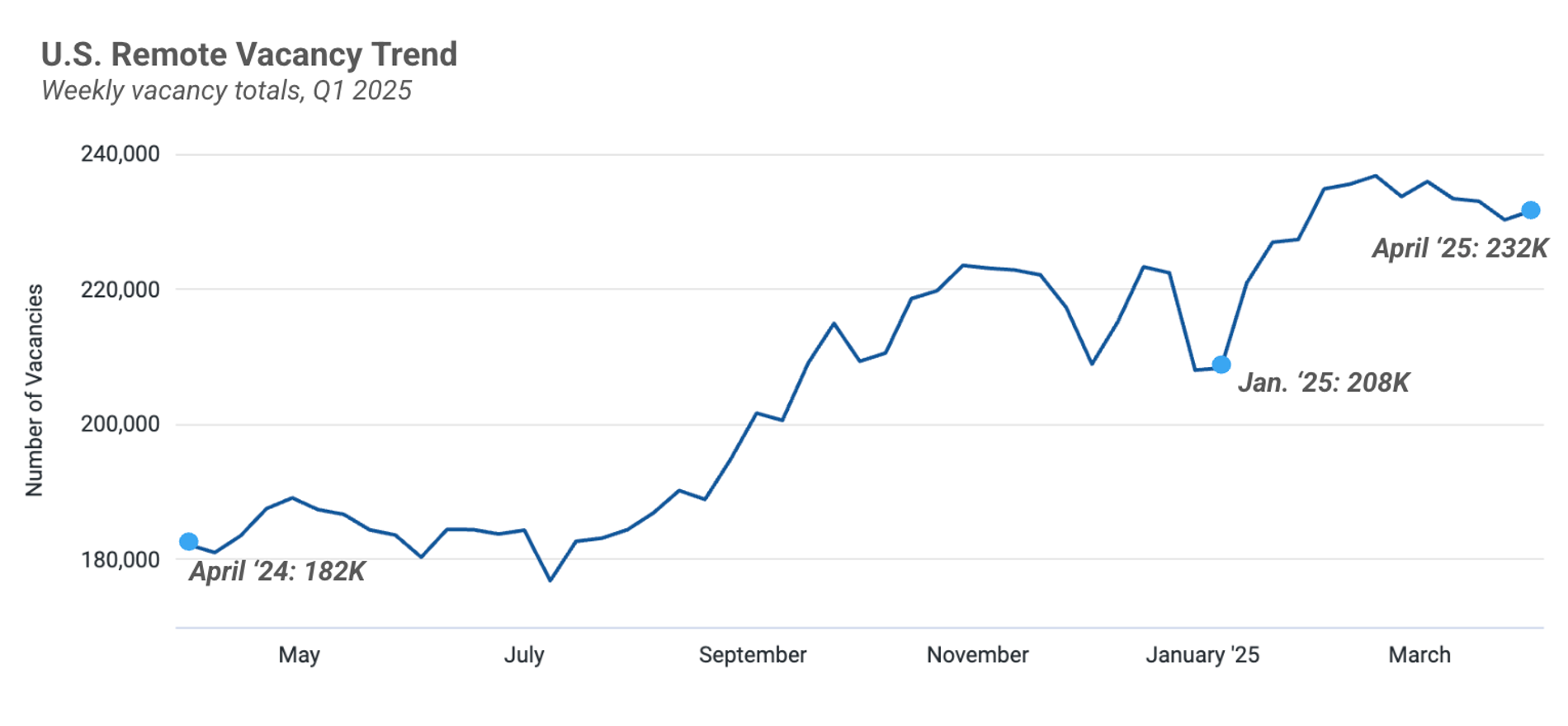

Remote jobs continue their strong growth trajectory, increasing by 27.5% compared to Q1 2024. Insurance, Information Technology, and Accounting sectors are leading this trend, underscoring the persistent shift towards flexible and remote working arrangements.

5. The Rising Impact of AI Roles

In the first quarter of 2025, AI-related job postings surged to 35,445 positions nationwide, marking an increase of 25.2% compared to Q1 2024. AI roles are increasingly strategic and command high compensation, with median annual salaries reaching $156,998—an increase of 0.8% quarter-over-quarter.

Additionally, AI skills are becoming integral across industries, highlighting the expanding role of AI in shaping the future workforce.

Aspen’s Q1 2025 U.S. Jobs Report highlights a labor market that remains active and dynamic, with strong job inflows, growing salary transparency, and steady demand across key sectors.

The ongoing economic uncertainty, driven in part by shifting tariff policies among other things, may influence employer job posting and hiring behavior in the coming months, and we are actively tracking these changes. We will be reporting on these changes in May (with a mid quarter report), and going forward. Stay tuned.

You can download the full report here.

Michael Woodrow – President at Aspen Tech Labs, Inc. | Founder at Healthcare Data Analytics, Inc.

[Want to get Job Board Doctor posts via email? Subscribe here.]

Comments (0)